Making an impact by thinking differently

We transform and grow businesses by seeing potential in complex situations, connecting people and delivering results. Sweeping levels of change requires new thinking, deep collaboration and transformative strategies delivered with rigour and expertise. It’s how we have earned our reputation as the leading turnaround and special situations investor to the UK mid-market.

Expertise

We bring a unique blend of entrepreneurial and analytical thinking. Our skilled people get to the heart of the issues quickly, help management teams deliver bold solutions and provide the right level of support every step of the way.

Trust and confidence

We’re proud of our long track record of deploying investment and growth capital, effective crisis leadership and delivering over 90 successful turnarounds.

Bold solutions

Our creative solutions are backed up with action. We unearth deep rooted challenges and work alongside management teams, without judgement, to activate change, develop people and create value.

Our Portfolio

JUNE 2025

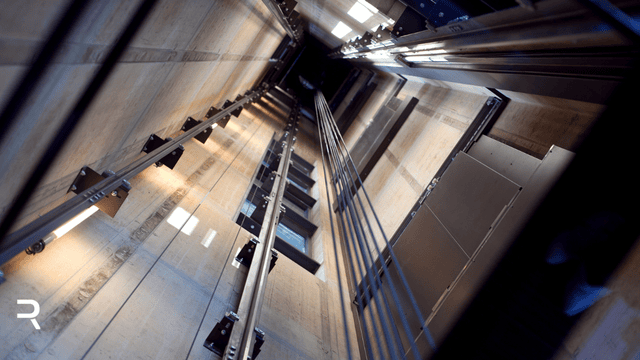

Liftec Express

FEBRUARY 2025

Gap Personnel

JANUARY 2025

GT Group

JANUARY 2024

FGP Group

NOVEMBER 2023

Phoenix Dosimetry Limited

OCTOBER 2023

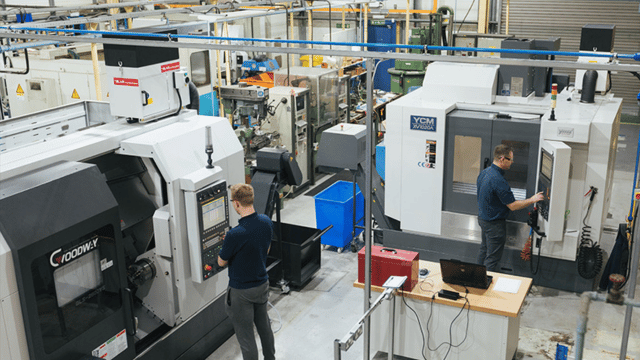

Surface Technology International (“STI”)

- Stressed or distressed mid-market businesses

- Profitable or loss making

- Bolt-on opportunities for Rcapital portfolio companies

- Carve-outs of non-core subsidiaries

- Difficult shareholder, business or management dynamics

- Shareholder / management looking for an exit from a business or sector

- Headquartered in UK or Northern Europe

- Turnover £5m-£250m

- Looking for up to £20m investment

- Established business (rather than start up)

- Quick response when urgent funding is required

- A solution for a challenging sale process

- Clean exit for a vendor where a sale process has failed

- Flexible and creative approach to complex deals and deal structures

- Speed and certainty in special situations

- Financial and operational support for MBO/MBI teams

- A solution for time-consuming / non-core subsidiaries